Hi folks,

Here's my list of insurance and Insurtech readings for this week, hope you enjoy it!

First, let's start with some industry and thought leadership publications:

McKinsey just released a great interview of Uwe Stuhldreier, an executive at HUK24, Germany's largest fully digital direct insurer. HUK24 is the largest direct motor insurer in Germany and the third largest overall in terms of its new motor business. HUK24 is trying to achieve what it Stuhldreier calls a “personalized insurance engine”: a fully automated customer journey, from initial product research and sales to claims, that leads each individual customer through a convenient, data-driven experience that feels fully tailored to them and comparable to interacting in person. Full interview here.

In its Insurtech survey, Digital Insurance finds out that still a 1/3 of polled insurers do not work with Insurtechs. It also finds out that insurers mostly work with Insurtechs to improve customer experience/satisfaction, a persisting theme for the industry in the wake of Covid-19. Full survey results here.

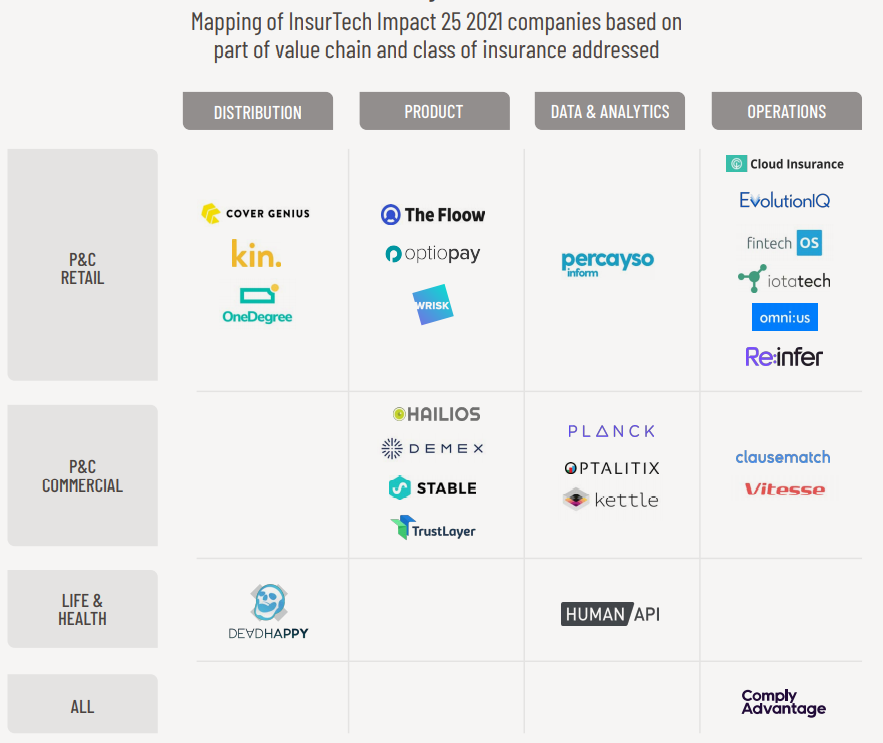

Insurance management consultancy Oxbow Partners just released its Insurtech Impact 25 study 2021, a must read for all Insurtech lovers. Oxbow comes back on Covid's impact on the industry and the pace of digitization. It highlights three trends to follow: (1) the move from affinity insurance to embedded insurance, (2) the need to invest in data and analytics to improve underwriting, and (3) the coming disruption of private health insurance. Oxbow also picks 25 Insurtechs to watch in 2021, with a strong bias for embedded insurance players. Full study here.

Copenhagen-based Insurtech-as-a-service Penni.io released its first Embedded Insurance Index. Penni.io makes a strong case for partner distribution in insurance, a trend which has remained on the margins, except for bancassurance (see below). The startup has conducted the first global survey of the state of digital partnerships in embedded insurance, with 41 companies across 13 countries responding. The survey points to real partner advantages to include insurance: increase revenue through insurance, expand customer offering and improve satisfaction, retention and lifetime value. On the other hand, embedded insurance is yet to become ubiquitous, mostly because of traditional carriers' inability to offer easy-to-integrate technological solutions that enable partnership sales. Full index here.

Estimates predict that “fully embedded” insurance distributed through partner channels will generate $140 billion in GWP by 2030 in P&C alone. That is 24% of the market share, compared to the 2% of the current market share

Cool read from IoT tsar Matteo Carbone on IoT's transformational potential in insurance. Carbone highlights the systemic impact that IoT can wield on carriers' insurance operations (claims, underwriting, risk reduction) and ability to increase frequency of contacts with customers and increase satisfaction. Full article here.

Second, this week has also seen lots of activity around M&A in the industry M&A, as well as new partnership signings between traditional carriers and Insurtechs:

Chubb extended a $23 billion buyout offer to acquire rival The Hartford, but the The Hartford's Board of Directors unanimously rejected the offer. Many analysts saw a strong financial and strategic fit between both players, arguing that Chubb would strongly benefit from Hartford's small commercial platform. Full article here.

In France, financial services and real estate broker MeilleurTaux acquires motor and health insurance broker Active Assurances. Thanks to the acquisition, MeilleurTaux moves from just being an aggregator to being an insurance broker. Full article here (in French)

AI pricing automation startup Akur8 signs multi-year partnership with Generali France to enhance the insurer's pricing processes and incrase modeling speed. Yet another partnership signed by Akur8 with a big name, following the announcement of a similar collaboration with AXA Spain. Full article here.

Tesla prepares to launch its in-house insurance program in three more states after launching in California in 2019. It was always Tesla's plan to scale its insurance program, but the company faced regulatory hurdles in some states. Tesla claims that it can leverage connected features inside its vehicles to provide cheaper insurance. Elon Musk estimates that that Tesla Insurance could reach a valuation that represents 30% to 40% of Tesla’s car business. Full article here.

ZhongAn, the Chinese online-only Insurtech, turned around its business in 2020, publishing strong financial results in 2020. Little known in the West, ZhongAn is one of the first Insurtechs to become public. ZhongAn turned an $85 million profit in 2020 (it improved its combined ration by 10.8 pts to reach 102.5%), and saw its GWP grow 14% mainly thanks to the growth of its health and digital lifestyle ecosystem. It's even broken into China's top 10 insurance companies (#9) in 2020. ZhongAn is world's largest embedded insurance company. to date. Two articles here and here.

Insurance company Aon partners with data underwriting startup Zesty.ai. Zesty uses AI to enhance the property underwriting capabilities of insurers. It provides access to more than 130bn data points, including satellite and aerial imagery, to enable risk analysis and informed pricing. Full article here.

SMB Insurtech Huckleberry partners with Berkshire Hathaway. The SME insurance space is hot in 2021. Following the news that Next Insurance was partnering with Amazon Business to provide SMB insurance, Berkshire Hathaway just announced a partnership with Huckleberry, an Insurtech which sells online workers compensation and general liability insurance to SMBs. Huckelberry raised $18 million in Series A capital back in December of 2019, and has led a quick geographic and product expansion in 2020. Full article here.

Now, some news on home insurance:

Luko, the French Insurtech focused on the home ecosystem, launched its fully digital building and co-ownership insurance. Luko argues that its product will be 10% cheaper than the market average, Full article here.

Apple's HomePod Mini has secret sensor waiting to be switched on. Trailing behind Amazon and Google in the smart home space, Apple launched its HomePod mini speaker last November. What we did not know is that the device has a secret sensor that measures temperature and humidity. Full article here.

Another week, another cool piece of content from Hippo Insurance. This time with a survey on The State of Homeownership in the US, one year into the pandemic. Home buying, improvements and repairs have been on the rise in 2020, with 16 million Americans in search of more space. With people spending more time at home, home improvements and maintenance increased significantly. Purchases of smart home products and devices, as well as home decor and finishings and office equipment, are also on the rise. Full survey here.

US self-storage marketplace Neighbor raises $53 million Series B led by Fifth Wall. The startup, which claims to offer storage rates that are approximately 40-50% less than traditional storage facilities, saw a 5X YoY increase in revenue from March 2020 to March 2021 and 7X increase in organic reservations. Full article here.

And last but not least, some fundraising news to conclude this week's readings:

German Insurtech unicorn Wefox is set to raise $250 million at a mind-boggling $2 billion valuation, its last funding round before IPO. The round should be led by German VC firm Target Global according to Sky News. As a reminder, Wefox has two businesses, its B2B2C platform for brokers called Wefox, and its customer-facing D2C brand ONE, which already 500,000 active policies and 350,000 customers, and provides household, auto, and liability insurance. Full article here.

SMB Insurtech Pie Insurance raises $118 million Series C led by Allianz X and Acrew Capital. Pie Insurance specializes in workers’ comp insurance for small businesses. Since 2017, it has received over $300M in funding, grown its GWP to over $100M, and partnered with over 1,000 agencies in the US. Full press release here.

Counterpart, a competitor of Next Insurance, raises $10 million led by Valor Equity Partners. Counterpart provides management liability insurance, helping wholesale brokersto allow small to medium businesses to get insurance coverage. Full article here.

That's all for this week folks!