Hello everyone,

New year, new resolutions! I dropped this newsletter since last September, and thought it might be worth reviving it in 2022. With a new and more manageable monthly frequency 😅

So, what’s to take away from January?

First, the US Insurtech public meltdown continues, with several US-based firms struggling to IPO (see Kin Insurance, which had to call off its SPAC IPO) or seeing their stock price plummet (Oscar: -79% vs IPO price | Lemonade: -54% | Hippo: -82% | Root: -91%). In the meantime, some private Insurtechs face existential challenges, like Root Insurance, which had to fire 330 people and get a loan from BlackRock.

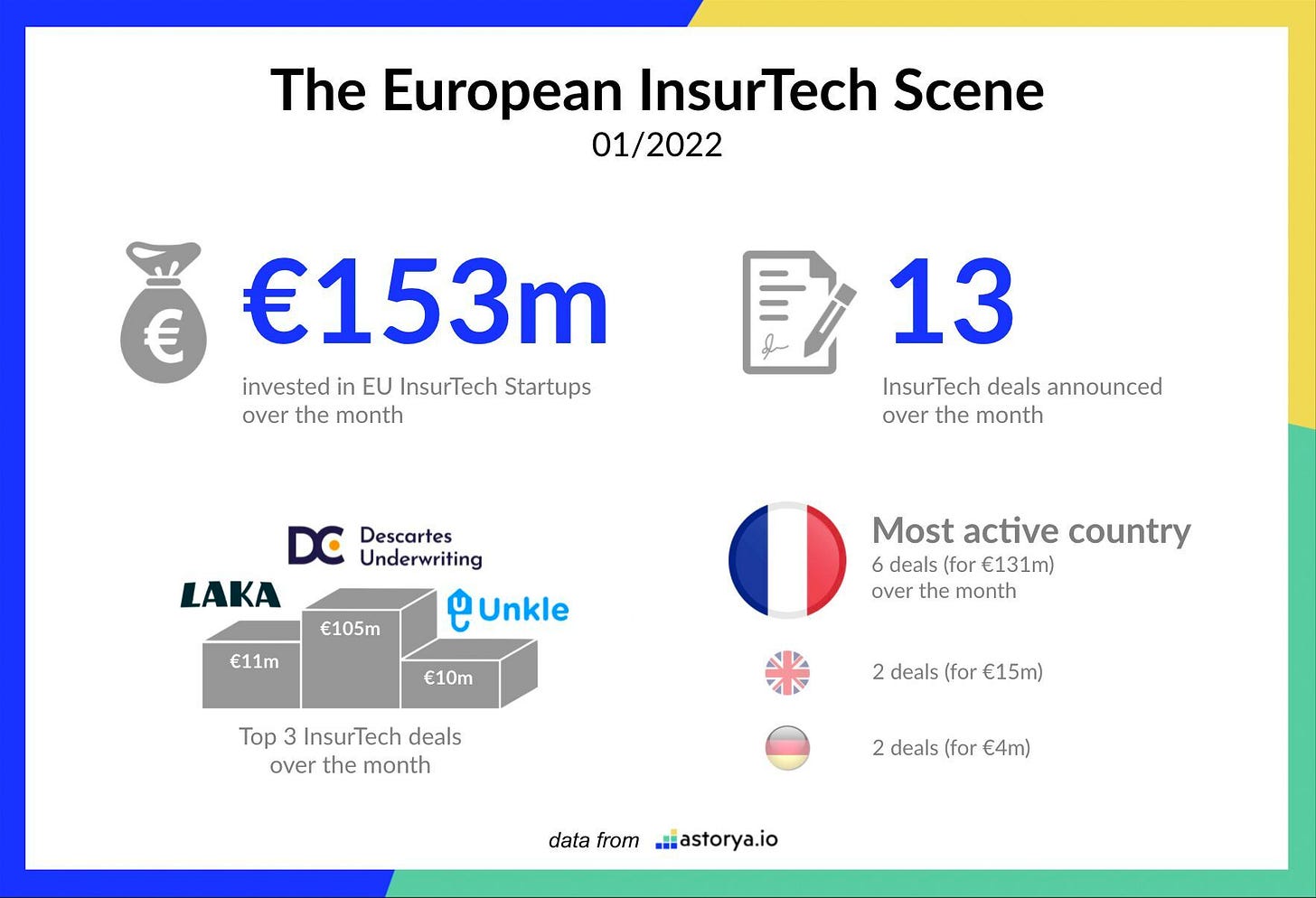

Second, despite the US Insurtechs’ public meltdown and after a record year of funding (€2.5bn raised by 92 companies), European Insurtechs continue to accelerate and attract funding. Special mention to French Insurtechs this month, which started off 2022 really strong (Luko expanding to Germany and getting its insurance licence, Descartes Underwriting, Indeez, Unkle, Flitter, Stoïk raising funding rounds)! We might even see the first (and long overdue) Insurtech IPO in Europe by the end of 2022. Make your bets!

So here are your monthly Insurtech insights, have a great read!

And don’t forget to share and subscribe if you like the content 😎

💲 Fund-raising news

Accelerant raises $190 million funding round at a $2 billion pre-money valuation led by Eldridge. Accelerant is a US Insurtech that provides tools to managing general underwriters to generate data analytics and exchange data 📰 Coverager

Descartes Underwriting raises a $120 million Series B led by Highland Europe and Eurazeo. Descartes is a Parisian Insurtech that specializes in parametric insurance products against climate-related risks. It will use the new funding to grow its technology platform, expand into new lines of business, target larger deals and recruit over 150 people in 2021 alone, including scientists and data engineers to work on its cat modeling technology. Acting as an MGA, Descartes serves +200 corporate customers and has generated over $50 million in GWP, with a $500 million GWP target in the next 3-5 years 📰 Insurance Journal

Sayata Labs extends its Series A round. After raising a $17 million Series A five months ago, the Israeli marketplace for insurance brokers and carriers gets an additional $32 million in funding from Pitango Growth and Hanaco Ventures. The company has ~1,000 users representing over 100 brokerage and carrier partners. It works with insurance providers including AXIS, Brit, Hiscox, Tokio Marine, At-Bay, Coalition, and others 📰 Coverager

Seel raises $17 million to boost its insurance offering for e-commerce. SF-based Seel, formerly known as Kover, pivoted a few months ago from offering income protection to the gig economy to offering insurance for e-commerce players to protect against the risk of product returns. Could Seel become the American Zhong AN? 📰 Coverager

Laka raises a $12 million Series A led by Autotech Ventures. Laka is a London-based bicycle insurance provider. It plans to use this new funding to open new markets starting with Belgium, France, and Germany, and expand its product suite to e-scooters, e-mopeds and e-cars 📰 Coverager

Unkle raises €10 million from Mundi Ventures to become a leading Insurtech for real estate players. Unkle provide rental guarantee solutions (including insurance) to create trust between tenants and landlords and facilitate access to housing 📰 Station F

Indeez raises a $9 million Series A funding round led by Elaia Ventures and Mosaic Ventures. Indeez is a French Insurtech that specializes in bringing income protection to platform workers such as gig workers, freelancers, temporary workers. These include protection benefits for liability, work accident, sick pay and other everyday business interruptions faced by platform workers. Indeez has already partnered with 20+ European platforms like Deliveroo, Brigad or Helping 📰 Indeez

Flitter raises €2.5 million Seed round led by Global Founders Capital. Flitter is a Paris-based pay-per-mile Insurtech that targets customers that drive less than 10,000 km/year. The startup promises annual savings from 30% up to 45% for drivers that drive less than 5,000 km. No telematics in Flitter’s model, the customer only has to send a picture of his/her mileage to benefit from insurance savings. Flitter is the latest addition to a small French pay-per-mile insurance market. Covid might change that, to be continued! 📰 Les Echos

Stoïk raises a $4.3 million Seed round led by Alven Capital. Stoïk is a French startup combining cyber insurance and a security software. The company targets SMEs with under €50 million in annual revenue, offering a security software to continuously mitigate their level of risk and insurance. The insurance component is provided by another French Insurtech, Acheel 📰 Coverager

Credits to Astorya.io for the nice January recap:

🚀 M&A, IPO and more

Luko acquires German Insurtech Coya and gains insurance licence. Both companies have been working on a deal since March 2021. It’s a 100% share deal, and Coya will now become Luko Insurance AG. The newly formed company aggregates Luko’s 220,000 home insurance customers in France and Spain with Coya’s 80,000-strong customer community in Germany, where it sells home content, private liability, dog liability and bike insurance. Luko plans to hire 100 more people this year and to reach 1 million customers by 2023. This deal signals Luko’s longer-term European ambition, and might also pave the way for Luko’s Series C round later this year 📰 TechCrunch

American Financial Group acquires underwriting startup Verikai for $120 million. Founded in 2018, Verikai leverages AI technology and alternative data to assess insurance risks 📰 Coverager

Next Insurance hires new CFO and gets ready for IPO. Next Insurance is a leading provider of SMB insurance solutions, and serves over 300k SMB clients in the US, slowly closing the gap with its competitor Hiscox (500k small businesses served). After releasing its new mobile app earlier this month, Next just announced the recruitment of Teodora Gouneva, a former finance executive at PayPal and AirBnB 📰 Coverager

While some get ready for the public markets, Kin Insurance calls off its own SPAC IPO with Omnichannel Acquisition Corp. The main culprit: “current unfavorable market conditions.” Kin finished 2021 with $104.8 million in total managed premium, compared with $25.0 million at the end of 2020. Not enough to go public at this stage 📰 Coverager

Root insurance has had a pretty bad week. It reportedly laid off 330 people during a Zoom call (link here), especially in its sales and claims teams, showing how it’s pivoting towards physical distribution with independent agents. At the same time, Root obtained an emergency $300 million loan from BlackRock (link here), reflecting new confidence in Root’s distribution pivot and partnership with used car marketplace Carvana.