Hi folks,

Happy Easter everyone! This is Romain, Product Manager at Direct Assurance. Hope you had a fun week. As every week, I’ll share with you some of my weekly readings and thoughts around insurance and technology topics, from industry insights and news to fund-raising activity. Feedback is more than welcome!

To receive your Insurtech digest directly in your inbox, subscribe here

And don’t forget to tell your friends 😉

📗 To start off this week’s newsletter, some insights from the industry

Consulting firm BCG just released its annual “State of Insurtech” report, with great insights on the trends that have been at work in the industry in 2020. BCG takes away 5 key trends:

Cumulative equity funding reached an all-time high of $7.5 billion

Insurtech is maturing, and reinsurers invested accordingly

2020 saw a flurry of insurtech M&A deals and seven notable IPOs

All regions registered record-breaking funding inflows

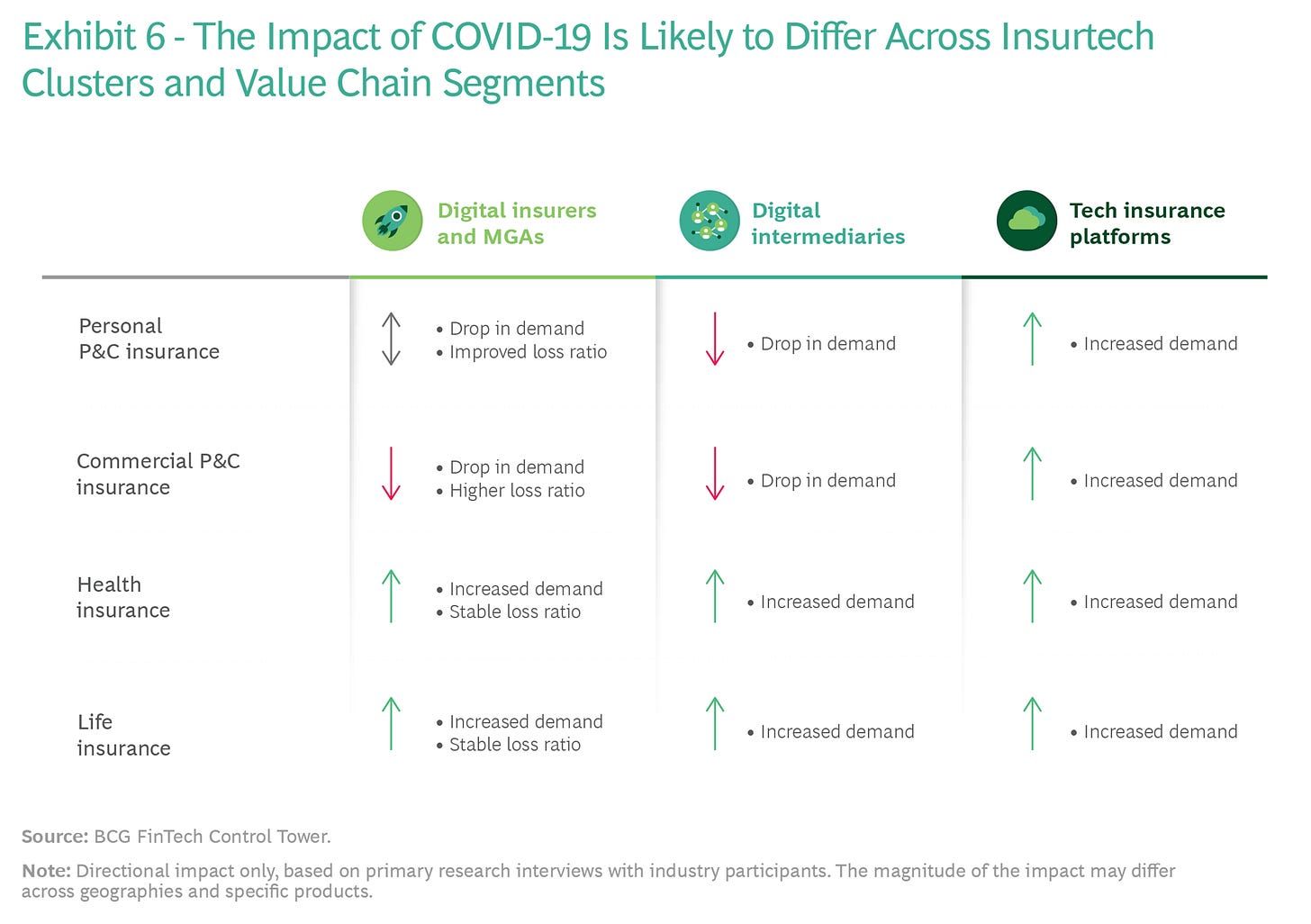

COVID-19 shook up the industry, altering risk pools for all lines of business

📰 BCG

The insurance carrier is back in fashion. After years of seeing VC dollars flowing into digital MGAs (only distributing insurance) and B2B tech enablers that serve traditional carriers, the full-stack model is back in fashion. Why is that? Many factors come into play according to Anthemis: entrepreneurs seeing the limits of the MGA model and seeking to control more parts of the value chain, investors and regulators feeling more comfortable with Insurtechs following a first wave of successful tech companies that are now exiting and more and more talents from traditional insurers joining fast-growing tech companies. 📰 Carrier Management

6 things you need to know about embedded insurance, from Chubb Studio’s Head of Digital. Embedded insurance is a burning topic in 2021. With the widening protection gap and increased digitization, embbeded insurance will represent a massive opportunity. Chubb’s probably one of the top carriers that is riding this wave of embedded insurance. It launched a global platform back in 2020, the Chubb Studio, to simplify and streamline the distribution of Chubb's insurance products through its 150 partners' digital channels around the world. 📰 LinkedIn

Akur8, a leading French pricing automation Insurtech, highlights the transformation imperative for insurers in a nice summary article. 📰 Akur8

Connected auto insurance and OEMs: are OEMs taking over auto insurance? 📰 Thinkmarket (in French!)

Cool summary of the Insurtech scene during the month of March, provided by Astorya.io 📰 Astorya.io

🚀 More news from the industry on M&A, partnerships, new products and collaborations

After years of inactivity, Allianz had a big M&A week. It first announced the acquisition of Aviva Poland for a whopping €2.5 billion, outbidding other interested carriers and strengthening its positions in central Europe. The very same week, rumours started to surface around Allianz’s possible interest in The Hartford, following Chubb’s rejected $23 billion offer. But Allianz seems to loathe entering a bidding war with Chubb. Will 2021 be another massive M&A year in the insurance industry? To be continued!

📰 Allianz agrees to acquire Aviva Poland

📰 Allianz Said to Study Hartford Situation After Chubb’s Offer

Zego, the UK commercial Insurtech, launches new flexible products for businesses in the food and grocery delivery market. More specifically, it launched two new flexible insurance products for moped and e-bike fleets in the UK, in partnership with Wakam. 📰 Insurtech Insights

Metromile, the US pay-as-you-drive Insurtech, plans to restructure its reinsurance agreement thanks to better financial performance. After narrowing its losses down to $37 million in 2020, Metromile looks to restructure its current deal, whereby it cedes 85% of its premium to 5 reinsurers. The company expects to end 2021 with 125,000 to 133,000 policies in force, up from 93,000 in 2020. An interesting read! 📰 Insurtech Insights

🏡 Some home insurance news

Hippo Insurance, the US Insurtech offering homeowners insurance, acquired First Connect Insurance Services for $25 million. First Connect Insurance services is a wholesale P&C insurance provider for independent agents. 📰 Coverager

UK home Insurtech Hiro announces backing from Wakam (ex-La Parisienne Assurances). Hiro rewards customers with discounted insurance for owning smart home products that can help protect their homes - like smart cameras, smoke detectors or leak detectors. Hiro was founded by former founder of Neos Insurance, another UK home Insurtech that was acquired by Aviva back in 2018. 📰 LinkedIn

💲 And last but not least, some exciting fund-raising news

Next Insurance, the US-based SME Insurtech, has raised a massive $250 million round at a $4 billion valuation, led by FinTLV Ventures and Battery Ventures. Next Insurance raised a total of $880 million to date. In a market historically underserved by traditional carriers, Next’s momentum in the last 6 months has been crazy: it doubled its gross written premium and now serves 200,000 customers; it completed two acquisitions (digital insurance agency AP Intego for $500 million, and open data and underwriting tech provider Juniper Labs); finally, it was named a small business insurance provider for Amazon Small Business SMB customers. 📰 PR Newswire

German Insurtech Getsafe looking to raise €50-€75 million. Main reason for the raise is to go full-stack. Getsafe started as a broker, then moved to MGA in 2017, and is now taking the underwriting risk too. When granted the Bafin agreement, Getsafe will start underwriting contents and liability products first. Just like Lemonade and other fully licenced carriers, Getsafe plans to cede roughly 70% of its premium to reinsurance. It now counts 170,000 customers, mostly in Germany but also in the UK, and plans to enter France, Spain and Italy in 2021. 📰 S&P Global

Salty, a US-based embedded insurance player, raises $15 million. Embedded insurance is a super hot topic in 2021. 📰 Crowdfund Insider

Crossover Health, a US digital-backed care provider, racks in $168 million in its Series D funding round. Founded in 2010, Crossover offers primary care and other services such as mental health care and health coaching to health plan and self-insured employer members. 📰 Mobilhealth News

AXA Venture Partners, AXA’s CVC firm, closes AVP Capital II, €250 million growth fund. It will invest in 4 distinct verticals: SaaS, digital health, Fintech/Insurtech, and consumer tech 📰Les Echos (in French!)

That’s all for this week, subscribe to receive more updates 🗞