Hi folks,

This is Romain, Product Manager at Direct Assurance. Every week, I’ll share with you some of my weekly readings and thoughts around insurance and technology topics, from industry insights to fund-raising activity. Feedback is more than welcome!

If you like this newsletter, please share!

📗 To start off this week’s newsletter, some insights from the industry

Great map of the embedded insurance space in the world by Dealroom. Embedded insurance represents a $3 trillion opportunity with huge benefits for tech enablers, insurers and customers alike. Its market share should increase 10x in P&C insurance by 2030 📰 Dealroom

A cool read by German seed venture capital firm Speedinvest on Digital health exits in Europe in Q1’2021. A few noticeable facts: 37 digital health exits in 2010-2021, digital health exits increased since the beginning of Covid (17 exits in 2020 and 2021 alone), all exits have been M&A (no IPO so far, but wait for Babylon Health or Doctolib in a few years time!), most acquirers are digital health startups themselves, and Germany leads with 10 exits, followed by Sweden and the UK. 📰 Speedinvest

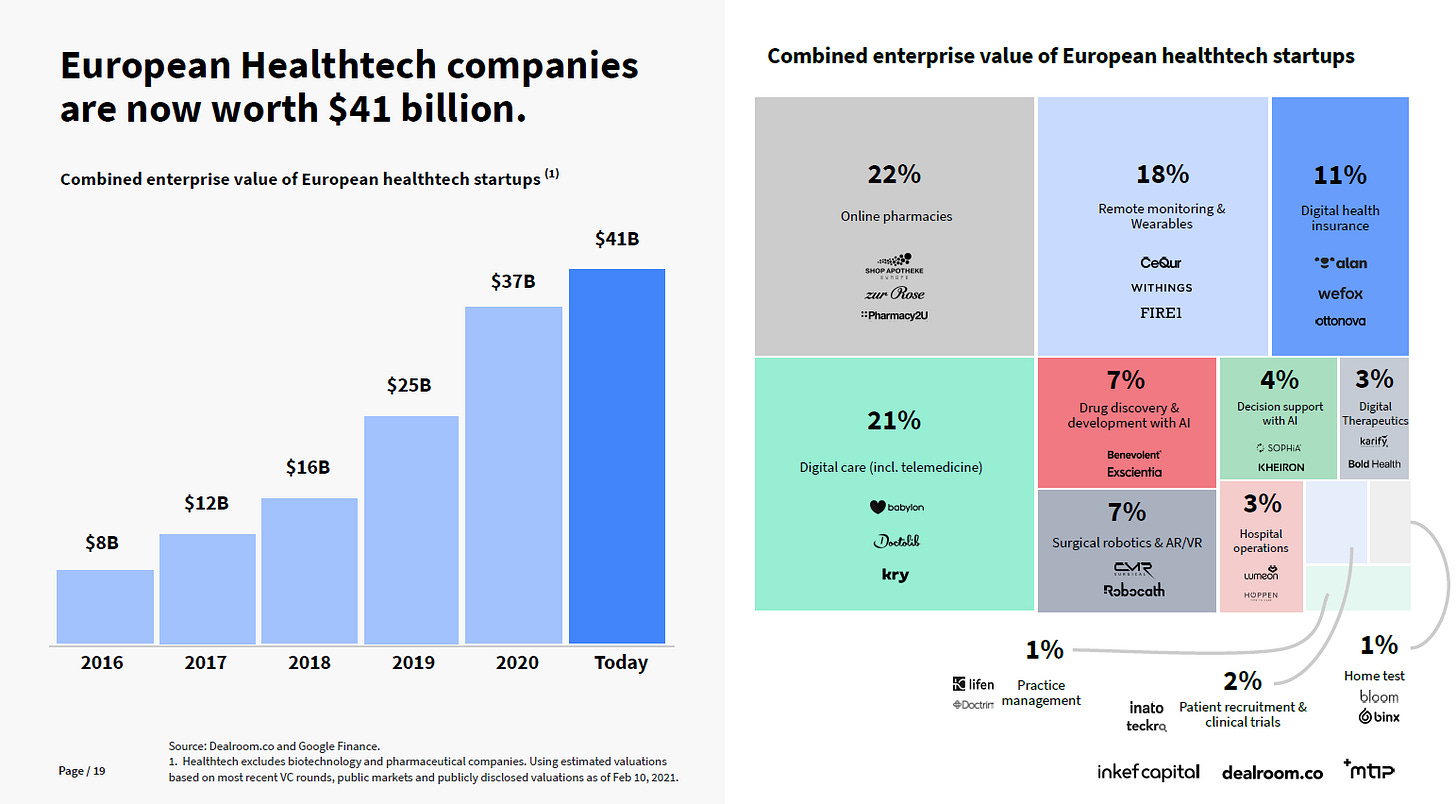

Dealroom, Infek Capital and MTIP released an awesome report on Digital Healthcare in Europe. Europe’s healthtech companies are now worth a combined $41B, up from $8B in 2015. As highlighted above, some healthtech unicorns are giants in the making, in telehealth (Babylon, Kry), operations (Doctolib, Docplanner), or health insurance (Alan, wefox). As pointed out by Speedinvest, deal activity is increasingly dynamic in the space, but so are partnerships between digital health startups. Below are a few slides from the report, it’s worth a read if you are into Digital Health topics. 📰 Dealroom

🚀 More news from the industry on M&A, partnerships, new products and collaborations

This week was marked by many product and partnership announcements between traditional carriers and Insurtechs, as well as between Insurtechs and Fintechs:

N26 enters insurance in partnership with Simplesurance, starting with on-demand smartphone insurance. Another big embedded insurance announcement this week, making N26 a serious challenger for traditional carriers! The Berlin-based online bank launches N26 Insurance and will allow customers in Germany to insure their smartphones against accidents and damage in partnership with Simplesurance, with prices starting at €6/month. Customers will be able to select and manage plans, buy coverage, and initiate claims directly from the N26 mobile and desktop apps. In the next few months, N26 plans to roll out new products in Germany and beyond, including home, life, travel, private liability, bike, electronics and pet insurance. The future of Bancassurance, you might say? 📰 TechCrunch

Bindable and IptiQ announce new partnership (and minority investment from the latter into the former). Bindable is a US-based Insurtech that seeks to digitize traditional insurance distribution in the P&C space. Through the partnership, Bindable will be able to leverage iptiQ’s digital life and health product suite to extend its offering in the US. IptiQ is Swiss Re’s digital insurance subsidiary 📰 Insurtech Insights

Akur8 announces partnership with French mutual insurance company Matmut to improve its P&C and health underwriting. Akur8 is on a partnership roll these days, signing Generali, AXA Spain, and Wakam as latest customers. It now announces its first mutual insurance customer, Matmut, which boasts 4 million customers in France 📰 Matmut (in French!)

Zego teams up with ultra-fast grocery delivery startup Dija on e-bike delivery cover. After announcing its latest $150 million Series C and becoming the first UK Insurtech unicorn, Zego gets a first UK customer for its new flexible commercial e-bike policy. Policies can go live in as little as one week 📰 Insurance Edge

Anthem, K Health and Blackstone launch Hydrogen Health, a new digital health joint venture. Following Amazon, JP Morgan and Berkshire Hathaway’s failed joint venture, called Haven, health insurer Anthem, telemedicine scaleup K Health and Blackstone Growth announce a new joint venture that aims to lower healthcare costs and make care more accessible. Hydrogen Health will develop new platforms targeting the direct-to-consumer, direct-to-employer and direct-to-insurer markets 📰 Fierce Health

Europe’s second largest insurer AXA also had its share of news and announcements this week:

AXA partners with Microsoft to build a digital healthcare platform in Europe. The platform, which relies on Microsoft Cloud for Healthcare, will be open to AXA’s customers in Germany and Italy, providing health services including a self-assessment tool, teleconsultation and a medical concierge to facilitate appointment-setting. The same week, Microsoft announced a massive move in the healthcare space, acquiring AI and speech technology specialist Nuance Communications for $19.7 billion, making it Microsoft’s second-largest acquisition after LinkedIn. 📰 AXA 📰 Nuance

AXA appointed Jef Van In as its new Chief Innovation Officer and CEO of AXA Next, following the departure of Delphine Maisonneuve, who becomes CEO of Groupe Vyv, a French mutual insurer 📰 Insurtech Insights

Last but not least, on the week of Coinbase record-busting $86 billion IPO, AXA Switzerland becomes the first all-lines insurer in Switzerland to allow its customers to make payment with Bitcoins. It’s just a start, as AXA Switzerland plans to add other crypto assets in the near future 📰 AXA

Lloyds’ Lab picks up 11 new Insurtech startups as part of its accelerator program. Many startups are focused on analytics and climate risks 📰Insurance Journal

In other news, Chubb published its FY2020 results, reporting a core operating income of $3.3 billion, down 29% due to Covid. And based on the quote below, which caught people’s attention, Chubb is going after Insurtechs big time 📰 Chubb

Our ultimate aim remains to use digital technology to modernize and reinvent the business of insurance. Some view insurtech start-ups as pioneers in this area. While these companies mix good customer experiences with clever marketing, most are not picking off better insurance risks and selecting against traditional insurers. Nor are they reinventing insurance and risk-taking. By contrast, digitization enabled us to process over $3.4 billion in business last year without human interaction between the agent and Chubb. In 2021, more than $200 million of premium will be delivered through direct digital channels, representing 40% compound annual growth from 2018, with an estimated 10 million policies sold. The results: a better customer experience, considerable efficiency savings for the company and, importantly, an underwriting profit from the actual business - something many high-flying insurtechs will not achieve for years, if ever.

Some home 🏡 insurance news

High street retailer John Lewis launches new, transparent home insurance product in partnership with Munich Re. The new product is said to be flexible and modular, with options to cover cyber damage, bicycles, gadgets. Customers can also make changes to their policy, in response to changes in lifestyle, without any extra fees. To reward customer loyalty, renewing customers will not pay a higher price than new customers 📰 Insurance Business

American Family Insurance partners with ADT to provide its customers discounts on ADT products, installation, and professional monitoring services. AmFam customers will be able to receive ADT smart home security systems at a discount. ADT is on a partnership roll, after signing similar deals with Branch and Hippo Insurance. 📰 American Family Insurance

Swiss insurer Die Mobiliar extends home ecosystem with acquisition of real estate portal Flatfox. Flatfox offers a free marketplace for property searches, as well as tools around the rental process. Another proof that insurers are moving beyond insurance and entering more aggressively into digital ecosystems 📰Coverager

💲 And last but not least, some exciting fund-raising and M&A news

Grab, the Singapore-based superapp that provides South East Asian consumers and entrepreneurs with mobility, deliveries, financial and healthcare services, plans to go public in the US in partnership with Altimeter in a $40 billion SPAC deal. Grab plans to raise $4.5 billion from the operation. Starting from deliveries, Grab has consistently moved into new segments, including financial services and insurance. Grab Financial Group (GFG), Grab’s Fintech unit, has sold a reported 100 million insurance policies in the last two years 📰 Bloomberg

US digital auto insurer Clearcover raises $200 million Series D led by Eldrige at unicorn valuation. In 2020, the company wrote ~$21M in premiums alongside a combined ratio of ~146%. 📰 Insurtech Insights

Austin-based The Zebra raises $150 million Series D allegedly led by Hedosophia, also at a unicorn valuation. The Zebra is an insurance comparison website, which first started with auto insurance before branching out to homeowners insurance. The Zebra doubled its net revenue in 2020 to $79 million compared to $37 million in 2019, and is on track to achieve a $150 million annual run rate at the end of 2021 📰 TechCrunch

Vericred raises $23 million Series B round led by Aquiline Technology Growth. Vericred sees itself as a Plaid for insurance, through its API-based platform that connects traditional carriers with new technology partners (HR/benefits software, Insurtechs, consumer apps) 📰 Crowdfund Insider

Penni.io, a Danish Insurtech-as-a-service upstart, raises €5.7 million from Seed Denmark Capital to scale its B2B2C embedded insurance distribution solution across Europe. Penni plans to expand in the Nordics as well as in France 📰 Insurtech Insights

Qare, a French teleconsultation provider backed by Kamet Ventures, was acquired by UK HealthHero for an undisclosed amount. The deal makes HealthHero, a highly acquisitive telemedicine provider, the largest telehealth provider in Europe, covering 22m people and providing more than 3m consultations a year. Qare has seen 800% growth in users over the past year, and provided 1m consultations last year 📰 Sifted

FRISS, a market leader in AI-powered fraud, risk and compliance solutions for P&C carriers, acquires Terrene Labs. Terrene provides the P&C Commercial Lines industry with risk insights. The announcement follows a record year for FRISS, with 58% revenue growth and an expanding client base in North America. 📰 Coverager

Société Générale Assurances backs Czech Insurtech Mutumutu with €1.3 million funding. Mutumutu operates in the Czech Republic and France in the space of life insurance, selling a prevention program based on a cash-back mechanism on the insurance premium 📰 Coverager

Nabla, a French healthtech, raises €17 million from French billionaire Xavier Niel. Nabla was first as a symptom checker and one-stop-shop mobile app for health needs (like K Health in the US), but now wants to be a healthcare superapp focused on women’s health, starting with medical chat with health professionals, community-based content, and soon telemedicine appointments 📰 TechCrunch

And that’s it for the week folks!