Hi folks,

This is Romain, Product Manager at Direct Assurance. Every week, I’ll share with you some of my weekly readings and thoughts around insurance and technology topics, from industry insights to fund-raising activity. Feedback is more than welcome!

If you like this newsletter, please share!

💥 If you only have 1 minute, here are the top 5 news of the week

1️⃣ French Insurtechs are hot this week: health insurtech Alan raises $220 million at unicorn 🦄 valuation, becoming the first French Insurtech unicorn and third European one, and online driving school and car neo-insurance company Ornikar raises $120 million.

2️⃣ Lemonade will launch Lemonade Car, its car insurance product, in 2021. Lemonade already offers renters, homeowners, pet health and term-life insurance, and will soon enter the large $317 billion US auto insurance market with a new offering.

3️⃣ Tractable, the provider of AI solutions for auto claims assessment and settlement, partners with Covéa, the largest car insurer in France.

4️⃣ Insurtechs are leveraging rapid growth to raise more funds in 2021.

5️⃣ Oscar Health, the US healthtech, goes B2B and launches +Oscar, a tech platform for US third party payers and providers.

📗 Insights from the industry

Great read from TechCrunch on the Insurtech’s space current momentum of rapid growth and big fund-raising news. The report covers Insurtech funding as a whole, but more specifically the state of Insurtech marketplaces like PolicyGenius, The Zebra, etc. 📰 TechCrunch (for subscribers only)

Another great read on digital ecosystems provided by Insurance Thought Leadership. Carriers will have to adapt to digital ecosystems by developing APIs, web services and micro-services in a coherent and business-friendly manner. Uber, for example, maintains an ecosystem of over 2,200 microservices. According to research firm Novarica, as of Q4 2019, more than 65% of insurers had deployed APIs/microservices 📰 Insurance Thought Leadership

Cool summary provided by Insurtech Insights on the transformational power of AI, blockchain and mobile on-demand technologies in the auto insurance space 📰 Insurtech Insights

🚀 New products, partnerships, collaborations and more

Tractable partners with Covéa, the largest French auto insurer through its three brands MMA, MAAF and GMF, to deploy its AI solutions that analyze damage to cars. Covéa will deploy Tractable’s computer vision solution to its network of thousands of bodyshops in France. It will enable Covéa to speed up the claims management process. Tractable’s AI solution allows insurers to evaluate the damage to a vehicle, based on photos provided by repairers, appraisers or consumers. It then shares repair method recommendations. Tractable’s AI has processed over $1 billion in auto claims for over 20 of the world’s top insurers 📰 Coverager

Oscar Health launches +Oscar, its B2B tech platform made available to third-party payers and providers. Leveraging high demand for digital health solutions, Oscar wants to make its tech stack more broadly available to third-party providers, provider-sponsored health plans and regional providers as first customers 📰 Insurtech Insights

Two accelerators chose their next batch of Insurtechs:

Plug and Play Insurtech Europe announces 14 Startups selected for Batch 6 📰 Plug and Play

French Assurtech, the French accelerator launched by 5 French mutual insurance groups, choses batch of 11 new Insurtechs 📰 Argus de l’Assurance (in French)

Wakam, the French insurtech, partners with UK insurtech So-Sure to co-create an innovative content insurance product in the UK 📰LinkedIn

Next Insurance, the US SMB insurtech, adds commercial property coverage to its suite of offerings. 📰 Digital Insurance

AXA XL, AXA’s large risks unit, teams up with SpaceAble to support safe and responsible activity in Low Earth Orbit. The partnership will allow AXA XL to enhance its insurance solutions for satellite operators, leveraging SpaceAble’s space-related data and modeling capabilities 📰 AXA XL

Akur8 signs yet another partnership, this time with Munich Re’s consulting unit, which will adopt Akur8’s pricing tech 📰 Munich Re

Home 🏡 insurance news

Kin Insurance achieves $100 million run rate in 1.75 years and with only $52 million in equity funding. Here’s to the efficient and frugal Insurtech company! 📰 PR Web

How sensorization really changes home insurance. According to Statista, there will be an estimated 482.8 million smart homes by 2025, to which smart sensors will contribute tremendously. Digital Insurance looks at the ways smart sensors will evolve in the future. Sensors will automatically contact a repair company or a concierge service before and once a leak is found, without even requiring the homeowner’s intervention. Sensors will also get smarter and do much more than just detect a leak and notify the homeowner 📰 Digital Insurance

Car 🚗 insurance news

Lemonade will launch Lemonade Car, its very own car insurance product, in 2021. Lemonade already sells renters, homeowners, pet health and term-life insurance, and will launch its auto insurance offering to tackle the massive +$300 billion US auto insurance market—70 times the size of both the renters and the pet insurance markets. Lemonade’s promise is simple: use technology to pay claims fast and handle emergencies, offer great prices to safe drivers, and make it more attractive for EV drivers 📰 Business Wire

Rivian, the US electric truck startup, unveils its proprietary and usage-based insurance coverage across 40 US states. Rivian promises lower premiums thanks to its connectivity and safety features. Rivian also offers peace of mind by bundling its customers’ insurance policies in one place, covering other vehicles, home, boat, camper and dirt bikes 📰 Rivian Insurance

💲 VC fund-raising and M&A news

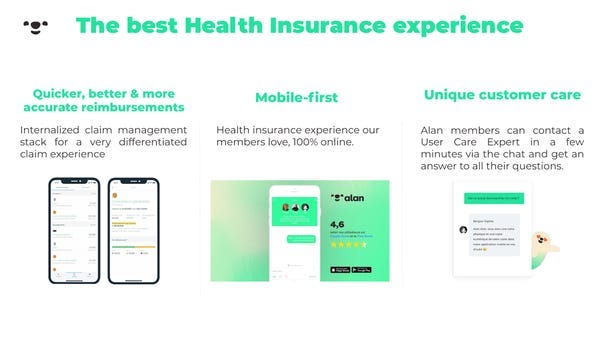

Alan, the French health insurance company, raises $220 million in additional funding led by Coatue, at $1.67 billion valuation, becoming first French Insurtech unicorn 🦄 Alan sells health insurance through employers, and bundle it with health services like telemedicine, medical chat, meditation, a geo-mapping of doctors, a service for new parents called Alan Baby, and more. It now covers 160,000 customers across 9,400 companies (mostly) in France, but also starts to gain speed in Belgium and Spain, with the goal of covering 1 million souls by 2023. It generates €100 million of annualized revenue. In turn, Alan’s goal is to become a healthcare superapp and one-stop-health-shop, like of Ping An Good Doctor in China 📰 TechCrunch

Ornikar, the French driving school marketplace, raises $120 million Series C led by KKR (at a reported $750 million valuation) to become a leader in driving education and road safety… and goes up a gear with car insurance. Ornikar Assurance offers car insurance in France only, and plans to have 20,000 customers by August 📰 TechCrunch

InsureQ, a Munich-based digital insurance platform for SMEs & freelancers, raises a €5 million seed round led by Nauta Capital. InsureQ aims to tackle the underserved self-employed and SME market in Germany, through its API integrations with B2B marketplaces and as an insurance agent partnering with leading commercial insurers such as Hiscox, R + V Versicherung and ARAG 📰 EU-Startups

Waterdrop, the Chinese health insurance and healthcare crowdfunding platform, will file for $100 million US IPO. Waterdrop is backed by Tencent, and is allegedly considered by Chinese regulatory authorities as running a risky business. In 2020, it booked $464 million in revenue 📰 Renaissance Capital

Archipelago raises $34 million in funding led by Scale Venture Partners. Archipelago provides a commercial property insurance risk platform to insurance brokers and large property owners. Over 330,000 commercial properties with total insured values of $2.3 trillion are currently on Archipelago📰 Insurtech Insights

Gradient AI raises $20 million Series B led by American Family Ventures. Gradient is an enterprise software provider of AI underwriting and claims solutions for commercial insurers 📰 Coverager

Ignatica raises $7 million pre-Series A led by growth capital private equity fund Ling Feng Capital. Ignatica is a Hong-Kong based insurance platform that allows insurers to launch and build new insurance products at lower costs 📰 Tech Asia