Hi everyone,

As mentionned in my previous email to you, I’m catching up this week with two longer editions of Techsurance before going on holidays 🛫🛬. This is the second newsletter of a (short) series of two. I wish you all a relaxing summer break, and will see you all in September with more Insurtech news!

And don’t forget to subscribe if you like the content 😎

For French-speaking readers (and football lovers like me!), Les Echos just published a nice piece on how to insure football star Leo Messi. Long story short, Messi’s value is probably at around €80 million. A specialist estimates that given the total value of all PSG players (around €800 million), the club pays €4-5 million of premium annually. Given his stature, Messi probably signed a “no-cut” contract with PSG, meaning that he’ll get 100% of his salary in the event of an injury. Less visible players usually need to take out an income protection and protection contract on the side to cover for injury, illness or death. Full article here 📰 Les Echos

💲 VC fund-raising and M&A news

In a dramatic U-turn, Aon and Willis Tower Watson called off their $30 billion megamerger due to regulatory uncertainties. The US Department of Justice was ready to block the merger, saying the buyout would reduce competition and lead to higher prices. As part of the breakup, Aon will pay $1 billion in termination fee 📰 Insurtech Insights

Hippo Insurance has known better days. The US home Insurtechs lost $192 million in funding before its SPAC deal as investors withdrew their funds in a sign of increased investor edginess over ballooning tech valuations. Hippo was expected to receive $230 million from the SPAC’s funds and another $550 million raised from institutional investors. Although Hippo has started trading at a value of $5 billion, as agreed with the SPAC entrepreneurs, it will have to make do with “only” $550 million 📰 Ctech

The Indian Insurtech landscape is burning hot, with two major (soo to be announced) deals grabbing attention:

Digit Insurance, which offers online health, car, bike, and travel insurance, raised $200 million at a whopping $3.5 billion valuation 📰 Coverager

Online insurance aggregator PolicyBazaar, which counts Softbank and Tiger Global among its backers, has filed for IPO and seeks to raise… $800 million! PolicyBazaar reportedly commandls +90% market share of the albeit small but growing Indian online insurance market 📰 Insurtech Insights

Cyber-insurance continues to attract VC dollars in 2021. US-based At-Bay raises $185 million Series D round co-led by Icon Ventures and Lightspeed Venture Partners. At-Bay offers cyber security coverage to businesses, and recently surpassed $160 million annual recurring revenue, a 800% year on year increase according to company figures 📰 Coverager

Root Insurance, the listed pay-per-mile auto insurer, received a fresh $126 million investment from Carvana, a US-based e-commerce platform for buying and selling used cars. The investment comes with the project to develop integrated auto insurance solutions for Carvana’s online car buying platform. After betting on direct online channels only, Root is expanding its distribution horizon to independent agents (see below) and B2B2C partners 📰 Insurtech Insights

The same goes for life insurance, which is traditionnally under-funded compared to P&C, but has witnessed a slew of deals in recent months. After YuLife a few weeks ago, and after already raising $200 million two months ago, US life insurance scaleup Ethos announced an additionnal $100 million investment from Softbank Vision Fund II at a $2.7 billion valuation. Ethos’ main differentiation lies in making life insurance simpler, more accessible and cheaper, thus attracting younger customer segments. The company said it expects to issue $20 billion of life insurance coverage in 2021 and it is nearing $100 million in annualized gross profit 📰 TechCrunch

Proof that Insurtechs are increasingly well-funded and looking to grow even faster, we see an acceleration of Insurtech-driven M&A deals and market consolidation, as illustrated in the last few weeks with the following deals:

Corvus Insurance, the US cyber insurance MGA which recently raised a $100 million Series C, acquires Wingman Insurance to expand to SMB and white-labeling 📰 Coverager

Bolttech acquires I-surance. We spoke about Bolttech’s latest fund-raising in this newsletter. It just acquired Berlin-based B2B2C digital insurance platform i-surance to expand its insurance exchange capabilities in Europe 📰 Coverager

In Greece, Hellas Direct, the digital insurer that recently raised $30 million, acquires road assistance provider Mapfre asistencia in a move to move beyond insurance in the mobility and home spaces 📰 Coverager

Just months after raising $28 million, Jerry announced today that it has raised $75 million in a Series C round led by Goodwater Capital at a $450 million valuation. Jerry offers a service to compare and buy car insurance. It wants to use the new funding to expand this car insurance comparison service to build a mobile-first car ownership superapp, building “compare-and-buy” services in new verticals, including financing, repair, warranties, parking, maintenance and “additional money-saving services.” 📰 TechCrunch

Besides cyber and life insurance, commercial insurance continues to be a hot space as well. Next Insurance nets fresh investment from Japanese insurer Mitsui Sumitomo Insurance (MSI) fours months after its $250 million Series D 📰 Mehabe

And fraud detection in insurance is also a big winner this year. After Shift Technology’s $220 million raise in May, its Dutch competitor FRISS raises a $65 million Series B led by Accel-KKR. FRISS serves insurers in over forty countries today, and is well on track to deliver over $2 billion in fraud savings to insurers in 2021 alone 📰 Coverager

And to finish this long and rich section dedicated to Insurtech funding, here’s a non-exhaustive list of smaller yet noteworthy deals that recently took place in the space:

Lovys, the French Insurtech that sells online home, car, mobile and pet insurance, announces a new investment from Adevinta Ventures as a follow-on of its Series Around. With the new funding, Lovys will expand to Spain and Portugal and continue its growth and recruitment. It currently boasts 50,000 customers, and plans to reach 100,000 customers by the end of 2021 📰 Coverager and two links in French 📰 News Assurance Pro 📰 Eficiens

London-based commercial MGA Flock raises $17 million Series A round led by Social Capital. Flock provides insurance for fleets of commercial vehicles, including drones, cars and vans 📰 Coverager

Agentero, a digital insurance network, raises $13.5 million Series A led by Alma Munti Ventures. Independent insurance agents use Agentero to access modern carriers and to boost their revenue 📰 Coverager

Afilio, a Berlin-based Insurtech, secures $13 million round led by CommerzVentures. Afilio provides a centralised location for families to create and consolidate personal estate management, legal, financial, and retirement/end-of-life planning 📰 TechEU

Naked Insurance, a South African insurance startup that offers car, home, renters, and single-item insurance, raises $11 million in a round led by Naspers Foundry 📰 Coverager

Breeze raises $10 million Series A funding round led by Link Ventures. Breeze offers supplemental insurance products like income protection and critical illness insurance in a 100% digital fashion 📰 Coverager

Collective Benefits, the UK health Insurtech, raises £6 million round led by NFX to expand the safety net for independent workers 📰 Insurtech Insights

🚀 New products, partnerships, collaborations and more

Amazon reveals insurance partnership with Marsh to help Amazon’s small business sellers get affordable product liability coverage. Through the new Amazon Insurance Accelerator, US-based small business sellers can get product liability quotes and purchase a policy that meets their needs and Amazon’s new coverage requirements (mandatory product liability coverage beyond $10,000 in monthly sales). The policies are made available digitally by two Insurtechs, Bold Penguin and Simply Business 📰 Coverager

Shenzhen issues China’s first digital yuan insurance policies, a major step forward in the broader deployment of China's digital currency 📰 Global Times

Tractable, the UK Insurtech unicorn that leverages AI for accident and disaster recovery, launches AI Subro (stands for subrogation, which is the right for carriers to legally pursue a third party that caused an insurance loss to the insured) in the US, a new product to help auto insurers recover loss and reduce loss ratios. The new product digitizes and accelerates subrogation tasks 📰 Coverager

Another week, another partnership announcement for Akur8, which partners with two subsidiaries of VIG in Poland 📰 Eficiens in French!

Home 🏡 and car 🚗 insurance news

Couple of news in the last few weeks from Luko, the French home insurance MGA. After crossing the 150,000 customer count, Luko announced its official launch in Spain, its first European opening and second country after France. To celebrate this occasion, it’s offering a €20 Amazon voucher, or 2 months of Luko Insurance to every homeowner or renter in Spain in exchange for 5 minutes of their time sharing feedback on the product and the onboarding process. In other news, Luko unveiled its first TV ad in France, called “Blue Home”. Its competitor Leocare unveiled its own ad a few weeks ago, showing that the competition to seize market share in France is heating up between home Insurtechs. And Luko also announced this week that it would now start insuring secondary homes 😎

Luko expands to Spain 📰 Coverager

Luko unveils its first TV ad (watch below) 📰 Eficiens

Luko now insures secondary homes (in French) 📰 Luko

Loop Insurance partners with mapmaker and location technology specialist TomTom for Loop to offer fairer and more transparent auto insurance prices 📰 Coverager

Really interesting trend from recently listed Insurtech companies: independent insurance agents are back in fashion! Once shunned by Insurtechs as too costly and old-fashioned, physical distribution networks are back. In the pay-per-mile space, Metromile and Root Insurance are both going after independent agents. Reckoning the crazy costs of acquiring new customers through direct online distribution channels, both players are now building physical distribution networks to acquire customers. Root opened the dance, launching an agent portal called Leftlane, and is currently piloting a program to make its technology available to independent licenced agents. Metromile is doing the same, and appinted 600 independent agents as part of its new internal program.

Hippo Insurance expands into commercial insurance market. The news broke a few weeks before Hippo’s (botched) SPAC deal. Its first product in the space is a tailored homeowners association (HOA) product 📰 Carrier Management

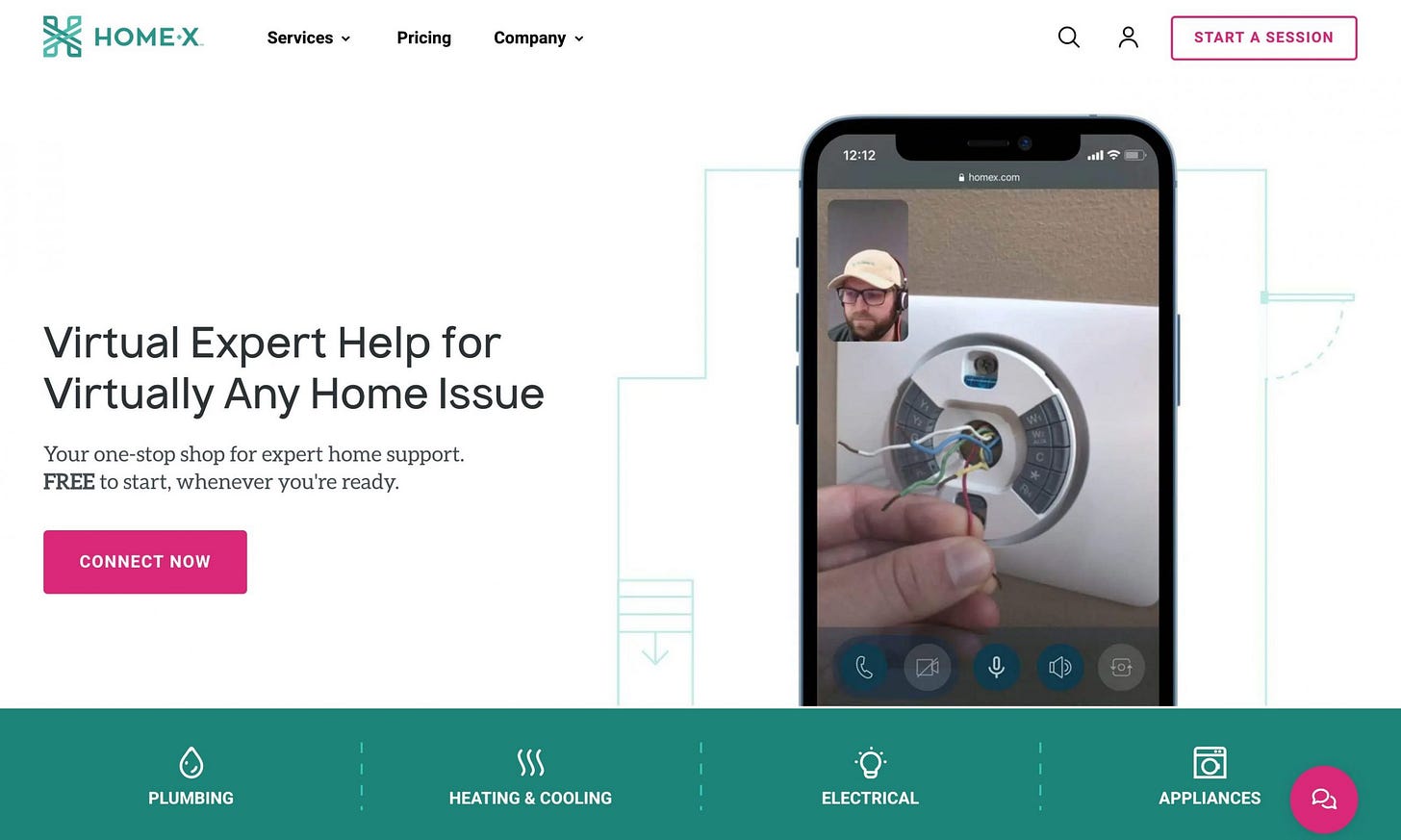

US insurers continue to test beyond insurance services in the home space. We have in mind players like Luko, Hippo Insurance, Nationwide and Progressive venturing into the “home care”/repair/maintenance space. Latest joiner to the party is Allstate, which will partner with home services company HomX to provide policyholders in Pennsylvania with a home maintenance/repair platform. 📰 Coverager