Hi everyone,

Hope you had a great week! Here’s your weekly Insurtech digest, subscribe and share if you like the content!

📗 To start off this week’s newsletter, some insights from the industry

Excellent read on why insurers need to develop loyalty and rewards programs to drive engagement, reduce acquisition costs, drastically improve retention and reduce oversized marketing and ad budgets in the industry 📰 Insurtech Insights

💲 VC fund-raising and M&A news

Corvus Insurance welcomes new investors, namely Aquiline Technology Growth and FinTLV, with $15M Series C financing extension. As a reminder, Corvus is a provider of commercial insurance products built on advanced data science. It announced a big $100 million Series C funding back in March 📰 BusinessWire

Ada Health raises $90 million Series B led by Leaps by Bayer. Ada Health is a German digital health startup that provides an AI-driven symptom assessment tool/checker to patients. The Ada Health app has been downloaded by more than 11 million people across 150 countries so far. Users have completed some 23 million assessments using the tool. Ada also offers a suite of enterprise solutions where partners (payers, providers) pay it to be able to embed and deeply integrate its triage technology into their websites and digital services. Ada’s vision is to become a personal operating system for health 📰TechCrunch

Parametrix Insurance raises $17.5 million funding round led by FirstMark Capital and F2 Venture Capital. Parametrix offers parametric insurance policies for companies that rely on third-party cloud providers, e-commerce services, payment gateways and CRM systems, compensating customers in the event of cloud downtime 📰 TechCrunch

Crypto insurance company Evertas raises $5.8 million in seed funding led by Morgan Creek Digital. Evertas helps companies reduce their exposure to cryptoasset related risk thanks to a a comprehensive underwriting framework for crypto and a full lifecycle insurance product for crypto 📰 Coverager

Mile Auto, a US pay-per-mile Insurtech, raises $10.3 million in seed funding from a group of investors (Ulu Ventures, Emergent Ventures, Thornton Capital, and Sure Ventures). Mile Auto claims that its technology can help low-mileage drivers save as much as 40% off their current auto insurance rates by collecting and validating odometer data without the need for extra hardware, mobile apps or GPS tracking. The same week, Mile Auto announced a partnership with Ford Motor Company, with the promise for Ford owners who drive under 10,000 miles per year to save between 30% and 40% off their current rates 📰 CrowdFund Insider

Obie raises $10.7 million Series A led by Battery Ventures. Obie has developed an Insurtech platform for landlords, targeting small-to-medium size apartment landlords who own single-family rentals and/or larger apartment buildings. It so far acts as a broker that provides instant and data-enriched quotes to landlords, but plans to become its own carrier and develop its product 📰 TechCrunch

🚀 New products, partnerships, collaborations and more

GEICO, the second-largest auto insurer in the US, partners with Tractable to accelerate accident recovery with AI. What a year for Tractable, which recently announced partnerships with France’s larges auto insurer, Covéa, and Poland’s Warta. And now GEICO. Today, Tractable’s AI processes over $2 billion a year in vehicle repairs and purchases, serving over 20 of the world’s top insurers, such as Tokio Marine and Mitsui Sumitomo, the largest auto insurers in Japan; Covéa, the largest auto insurer in France; and Admiral Seguros, the Spanish entity of Admiral Group 📰 Coverager

Allstate’s mobility data and analytics company, Arity, launches Arity IQ to enable insurers to offer consumers the most accurate price by leveraging driving behavior data at new business. It remains a bit unclear how Arity IQ can process and leverage so much “driving behavior data on tens of millions of consumers gathered from mobile apps”, but it looks promising 📰 Insurtech Insights

Back Market, a French marketplace for refurbished devices, launches a new insurance offer for refurbished smartphones, tablets and laptops in partnership with BNP Paribas Cardif and I-surance. Initially available in France, Spain and Germany, this new offer will progressively be rolled out in several other European markets 📰 BNP Paribas

Home 🏡 insurance news

Lemonade tweet thread about AI-powered insurance backfires. Another bad news for Lemonade this week. In a series of 7 tweets—all deleted since—Lemonade explains how its AI algorithms gather more than 1,600 data points about its users, how its AI carefully analyzes videos to detect fraud and pay less claims, including based on “non-verbal cues”. Lemonade has been accused of discriminating against users based on physical characteristics, but denied these accusations in a new series of tweets. Full story here 📰 Recode

Homeowners Insurtech Hippo partners with CAPE Analytics to leverage CAPE’s geospatial analytics to deliver risk assessment and mitigation insights at faster speeds and with greater accuracy. CAPE identifies valuable property characteristics such as a roof’s condition, yard debris, solar panels, overhanging trees, swimming pools and more with faster speed and accuracy than traditional third-party data sources. This intelligence will support further automation of Hippo’s underwriting process and even enhance its renewal capabilities, replacing the need for in-person inspections 📰 IIReporter

Another great piece on Hippo’s future SPAC deal and current financial/operating performance, with a thorough coverage by Seeking Alpha, which deems that Hippo is a poor investment given its super expensive valuation and poor operating metrics, especially its high 120% combined ratio 📰Seeking Alpha

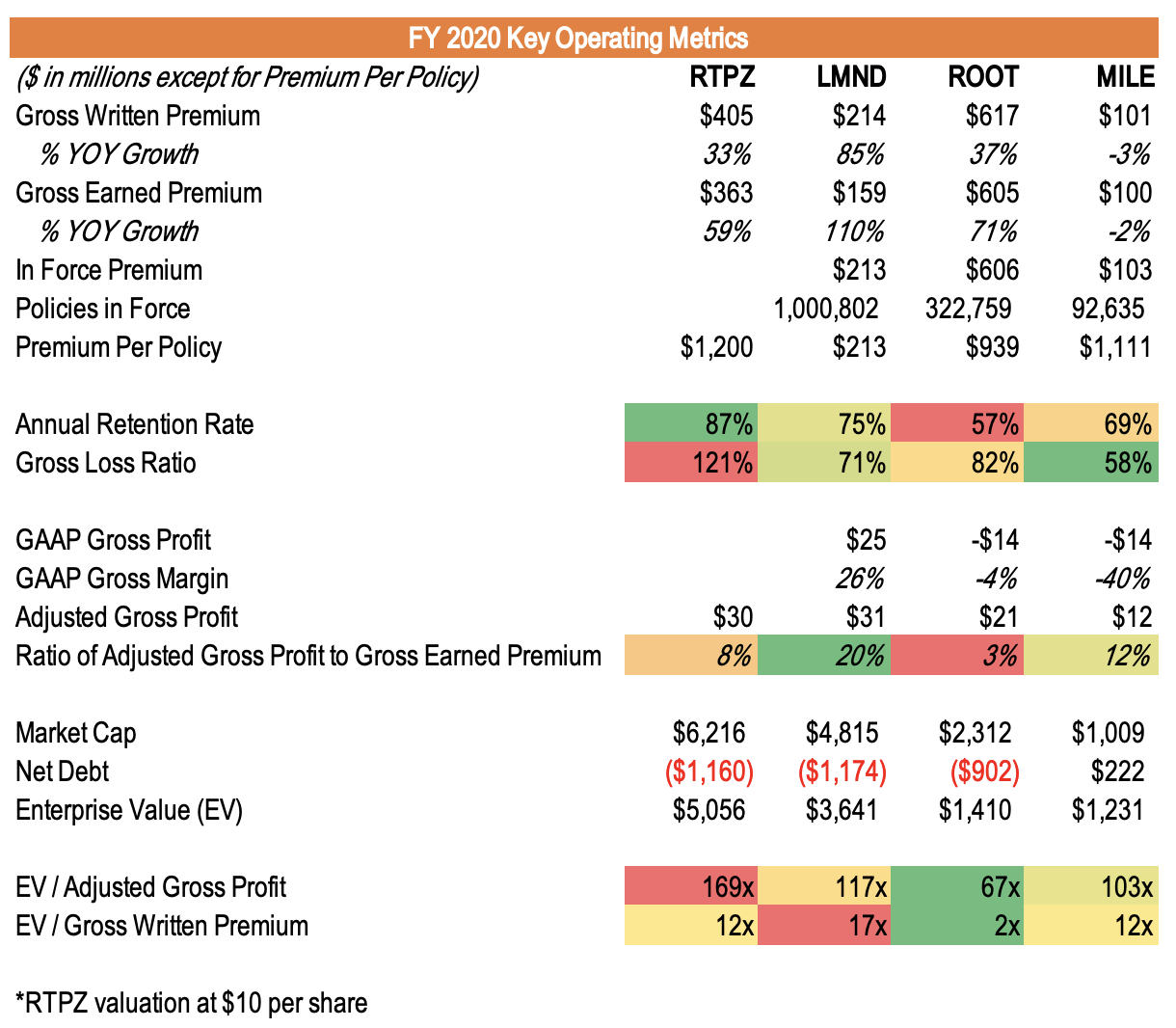

Below is a cool table from Seeking Alpha comparing the main public Insurtechs’ key operating metrics (RTPZ refers to Hippo’s SPAC merger partner, Reinvent Technology Partners Z):