💥 If you only have 1 minute, here are the top 5 news of the week

1️⃣ Insurtechs raised $2.55 billion across 146 deals in Q1’2021, making it the highest fund-raising quarter on record

2️⃣ Big week for digital health startups, with Kry (EU) raising $312 million and Kaia Health (US) raising $75 million

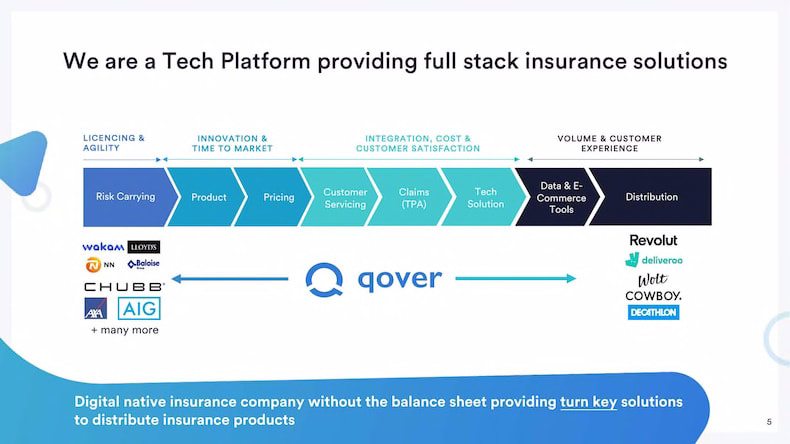

3️⃣ Belgian Insurtech Qover raises $25 million

4️⃣ Luko, the French home Insurtech, announces new partnership with AirBnB

5️⃣ Elon Musk plans to take motor insurers out of business

📗 Insights from the industry

CB Insights and Willis Tower Watson just released their quarterly Insurtech report. It was a record quarter, Insurtech funding reached an all-time high $2.55 billion (+22% versus Q4’20) across 146 deals (+42% versus Q4’20). Most of the funding was driven by P&C companies and a record number of mega-rounds (Coalition, Zego, Pie Insurance, Corvus Insurance, …). 📰 CB Insights

Cool read from Oxbow Partners on cryptocurrencies and how insurance can contribute more. So far, the crypto industry remains 96% uninsured. Insurers can act in three ways by (1) becoming crypto underwriters, both for crypto risks and crypto businesses, (2) accepting crypto as a payment (AXA Switzerland recently accepted Bitcoin) and (3) holding crypto as a balance sheet item. Oxbow still notes some risks linked to the crypto mania: difficult technical underpinning, volatility and concentration risks, and regulatory uncertainty 📰 Oxbow Partners

🚀 New products, partnerships, collaborations and more

Chubb and Marsh announced a collaboration with the World Health Organization (WHO) and Gavi, the Vaccine Alliance (Gavi) to offer 92 lower-income countries compensation against rare adverse effects of Covid19 vaccines 📰 Insurtech Insights

Home 🏡 insurance news

Luko, the French home Insurtech, designs new temporary rental guarantee and announces new partnership with AirBnB France, allowing new AirBnB hosts to have 1-year worth of free home insurance 📰 AirBnB

Car 🚗 insurance news

Tesla has registered the German branch of its insurance product as its giga factory in Berlin nears completion 📰 Tesmanian

Elon Musk plans to put motor insurers out of business 📰 The Driven

💲 VC fund-raising and M&A news

Kry, the Swedish telemedicine startup, closes $312 million Series D led by the Canadian Pension Plan Investment Board to accelerate its European expansion. Kry’s year-over-year growth in 2020 was 100% — meaning that the ~1.6M digital doctors appointments it had served up a year ago now exceed 3M. Some 6,000 clinicians are also now using its telehealth platform 📰 TechCrunch

Qover, the Belgian Insurtech, raised $25 million Series C led by Prime Ventures with participation from Cathay Innovation. Another week, another embedded insurance news! Through its API, Qover offers insurance products (travel cover, device protection) to firms like Deliveroo, Revolut, Wolt, Cowboy and Decathlon 📰 Times News Express

Arturo, the US property analytics company, raises $25 million Series B led by Atlantic Bridge Capital. Arturo extracts property data from the latest satellite, stratospheric, aerial and ground-level imagery, as well as unique proprietary data sources 📰 Insurtech Insights

Kaia Health, the NYC based digital therapy startup, raises $75 million Series C. Kaia says it grew its business book 600% in 2020 📰 TechCrunch

Sigo, a Latin American MGA providing underserved populations with affordable access to auto insurance, raises $1.5 million seed round. Looks a bit like what Loop is trying to push in the US 📰 PRNewswire

OKO, an African Insurtech that offers farm/agricultural insurance, raises $1.2 million in seed funding. The startup operates in Mali and Uganda 📰 OKO