Hello everyone,

I'‘ve been on holidays the past few days, so its a late and probably shorter version of Techsurance that you are receiving from last week. Last week’s big Insurtech news was the massive $220 million funding round from French fraud detection Insurtech Shift Technology. More information below ⤵

Have a great rest of the week!

💲 VC fund-raising and M&A news

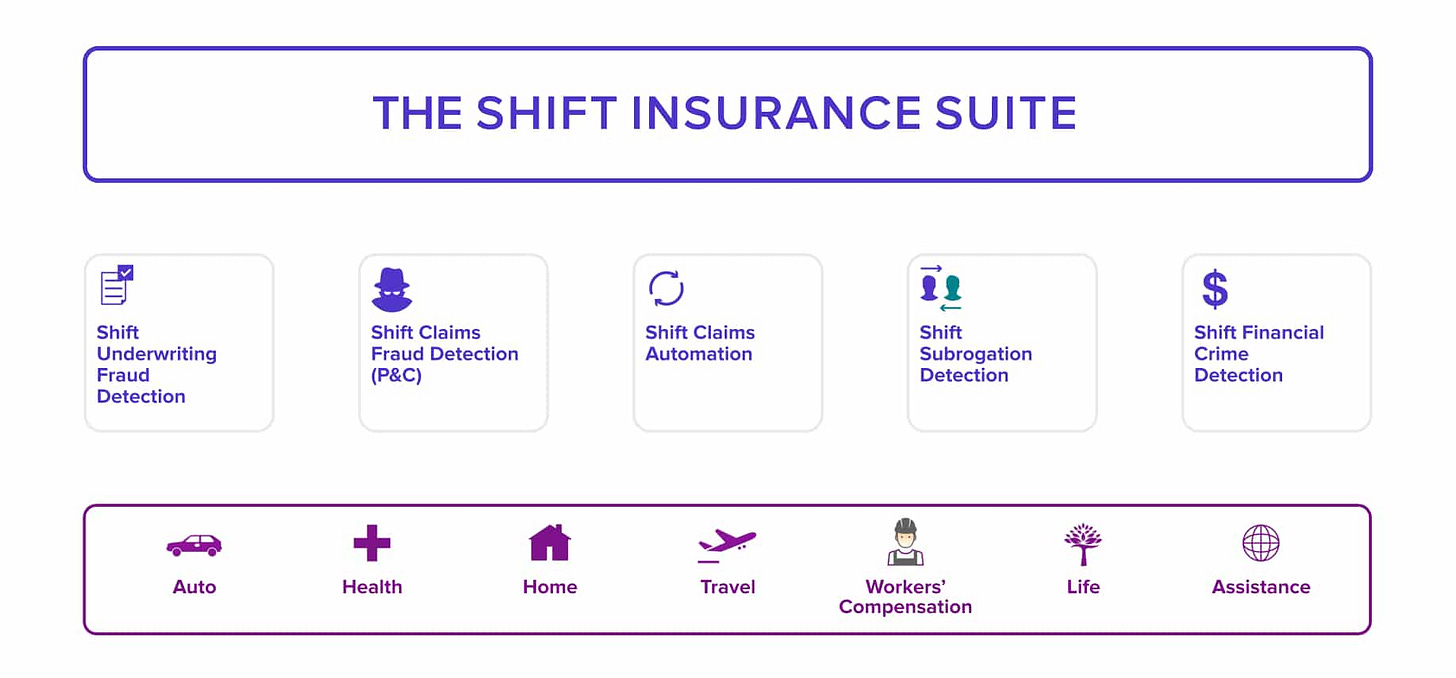

Shift Technology raises $220 million Series D led by Advent International, at a reported $1+ billion valuation. Another week, another French unicorn! The European Insurtech space is burning hot right now, and Shift is just riding the wave. Shift is well known for its AI-based fraud detection tool, with an application to P&C businesses, but also in health and travel. Shift plans to use the funding to further accelerate in the US. Shift currently has around 100 customers across 25 different countries —Generali France and Mitsui Sumitomo— and says that it has already analyzed nearly two billion claims. Exciting times ahead for Shift! 📰 TechCrunch

Headway secures $70 million Series B funding at a valuation of $750 million. The round was led by Andreessen Horowitz. Headway provides free software that connects patients, therapists and insurance companies. Since going live in April 2019, Headway enabled 3,000+ therapists, psychologists and psychiatrists to accept insurance, added more than 2,000 patients to the platform each month, and facilitated over 300k therapy appointments 📰 Coverager

Sprout.ai raises $11 million Series A led by Octopus Ventures. Sprout.ai provides an advanced claims automation solution, including through NLP and OCR, for global insurers like Zurich. The company says it can shorten the claims settlement process from 30 days to just 24 hours 📰 Cambridge Network

Some big digital health fund-raising rounds took place last week:

Collective Health raises $280 million in new funding at $1.5 billion valuation. Among its new investors is Health Care Service Corporation, a major seller of Blue Cross Blue Shield health plans, as an investor and business partner. Collective Health offers employers a way to knit together various health benefits -- medical, prescription drug, dental, vision, as well as other specialized offerings — on a single technology platform. The company has more than 500 employees and serves about 300,000 members across more than 55 companies 📰 Bloomberg

Vida Health closed a $110 million Series D funding round led by General Atlantic and joined by Centene, AXA Venture Partners (AVP), and Ardea Capital Partners. Vida Health does XYZ. The company has more than tripled its revenue since the beginning of 2020 and expanded its existing nationwide network of therapists, coaches, dietitians, and diabetes educators by more than 400%. Vida’s clients include employers like Boeing, Visa, Cisco, eBay, and large payers like Centene, Humana, and Blue Cross Blue Shield plans 📰 Forbes

Walmart Health is set to acquire on-demand multispecialty telehealth player MeMD. Another strong signal and stepping stone in Walmart’s big ambitions in the US in healthcare delivery (remember Walmart Health Centers) and competition with Amazon and its Amazon Care brand 📰 Becker’s Hospital Review

China Insurtech Waterdrop raises $360M in New York IPO. As written in this newsletter some weeks ago, Waterdrop was looking to IPO in the US to avert regulatory scrutiny of the fintech sector currently underway in China 📰 Insurance Journal

🚀 New products, partnerships, collaborations and more

Dalma launches as the latest pet insurance player in France, with $2 million in seed funding from FRST and Global Founder Capital. Only 6% of pet are insured in France, and Dalma wants to tackle this growing market in a 100% digital fashion and with an agressive pricing (no deductible and €7.99/month for a cat and €10.99 for a dog) 📰 L’Argus de l’Assurance (French)

Particeep, the French Insurtech as a service solution provider, partners with Metlife in France. Metlife France will leverage Particeep Plug to distribute insurance directly on its website and through distribution partners 📰 Particeep

Reinsurer SCOR partners with Insurtech Snapsheet on digital claims management solutions. The partnership will enable SCOR customers to have access to an end-to-end claims management platform, digital payments platform, motor virtual appraisal offering, and set of third-party integrations 📰 Reinsurance news

Aviva introduces new bicycle insurance in partnership with Ripe. The new product – Cycleplan – can cover multiple bicycles and accessories, both at home and while out and about 📰 Coverager

Home 🏡 insurance news

Home insurtech Hippo's tech-hiring spree brings first CIO. Hippo continues to accelerate with the announcement of a series of hiring to reinforce its technology organization, including its first CIO and CISO 📰 Digital Insurance